- Introduction

- Other Homebuyer Programs

California Dream For All Shared Appreciation Loan

Program Highlights | Eligibility | Documents Needed | Shared Appreciation

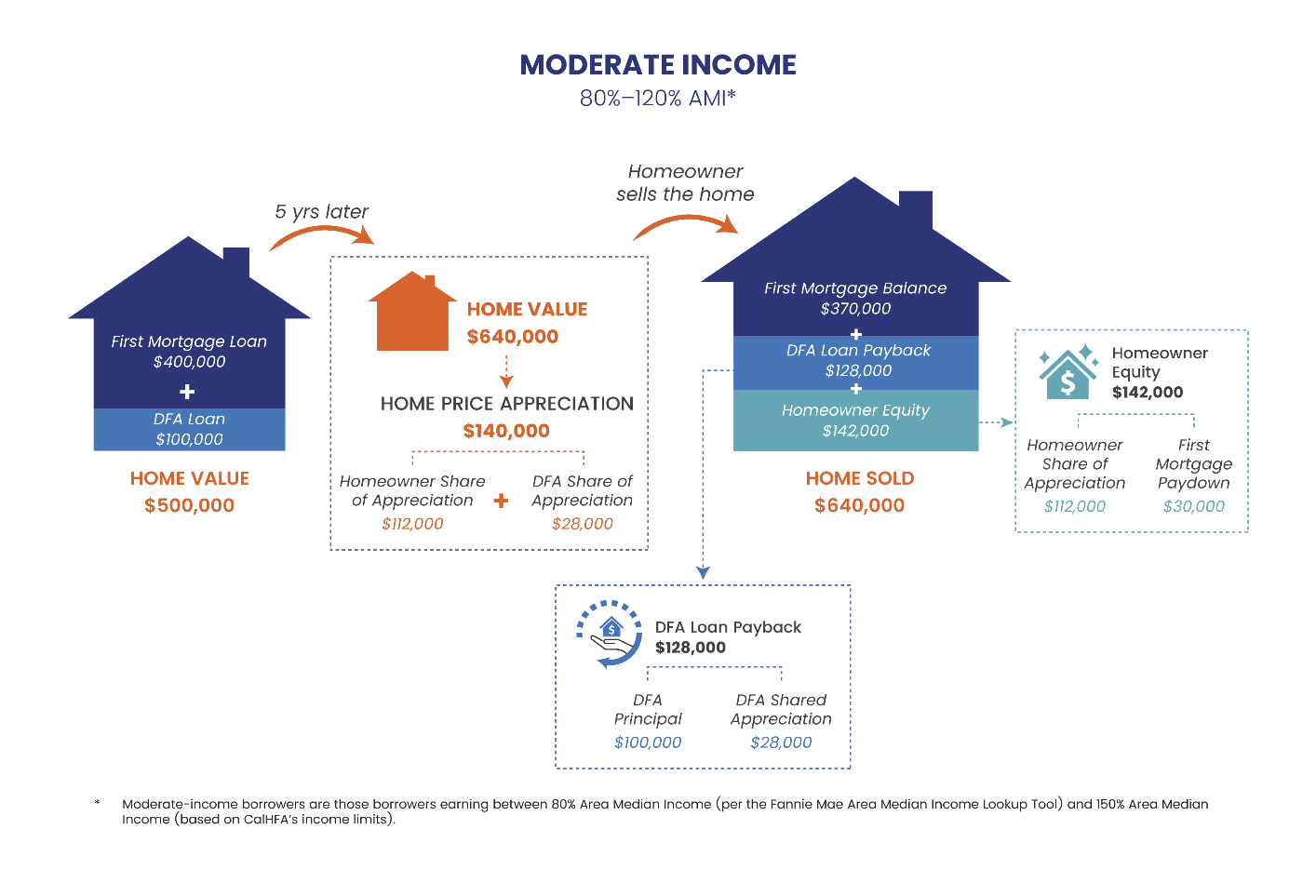

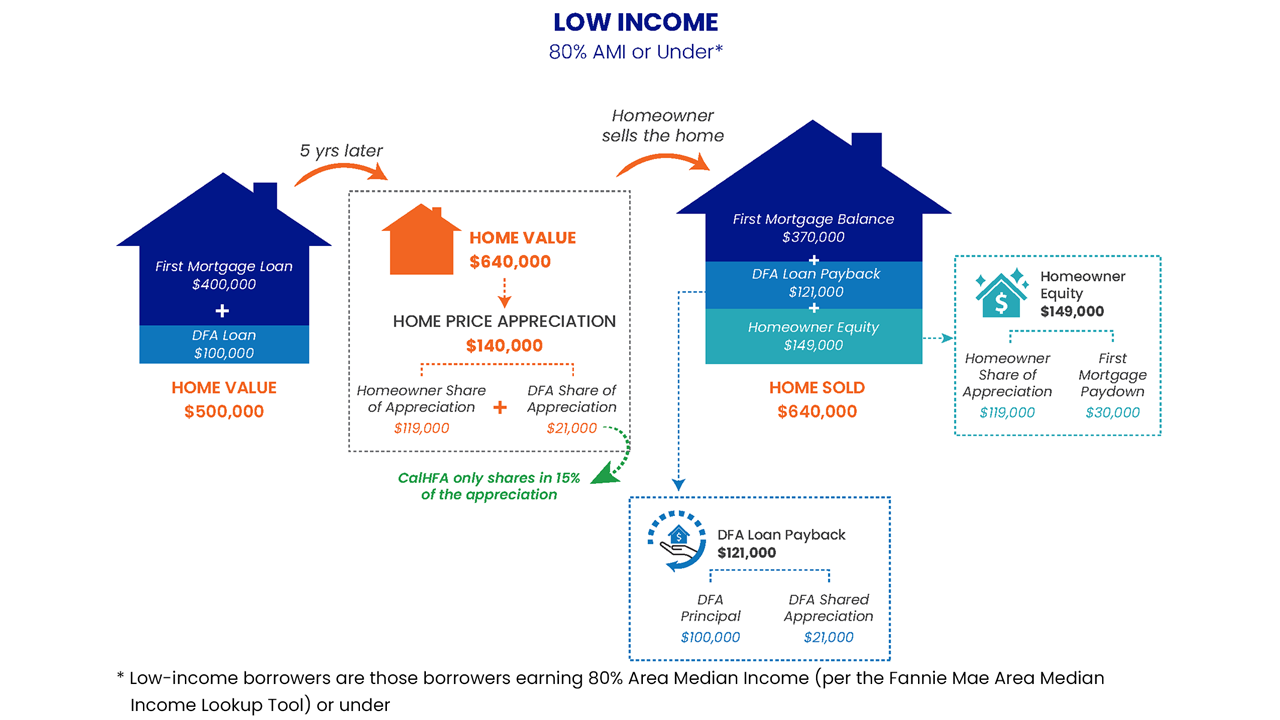

The Dream For All Shared Appreciation Loan is a down payment assistance program for first-time homebuyers to be used in conjunction with the Dream For All Conventional first mortgage for down payment and/or closing costs.

Upon sale or transfer of the home, the homebuyer repays the original down payment loan, plus a share of the appreciation in the value of the home.

If you applied in previous rounds and were placed on a waitlist or received a DFA voucher, you may access the Voucher Portal to view your voucher status, download a copy of your voucher, request a one-time extension, or cancel your voucher.

Voucher registration will open again in early 2026.

Start preparing now.

Program Highlights

- Offers up to 20% for down payment or closing costs, not to exceed $150,000

- Homebuyer must register for a voucher. A randomized drawing will select registrants who will receive the voucher. This will not be first come, first served.

Eligibility

- One borrower must be a first-generation homebuyer.

- One borrower must be current resident of California.

- All borrowers must be first-time homebuyers.

- Income must meet CalHFA Income Limits for the county you are purchasing in.

Documents Needed

- California Dream For All (DFA) Lender Pre-Approval Letter

- Government ID: Passports, driverís license, state-issued ID, military ID, permanent residence cards, visas or employment authorization documents

- Foster care documentation (if applicable): Foster Care Verification Form/Letter or court documents

- The DFA Voucher application will require information for both parents of the designated first-generation borrower(s) including:

- Name

- Date of birth

- Date of death (if applicable)

- Current address

- Proof of parent relationship

- Birth Certificate

- Adoption papers

- Sign up for our enews to get updates

Shared Appreciation

Shared Appreciation is a little more complex than a typical mortgage loan, so weíve put together a few examples for you.