- Introduction

- Other Homebuyer Programs

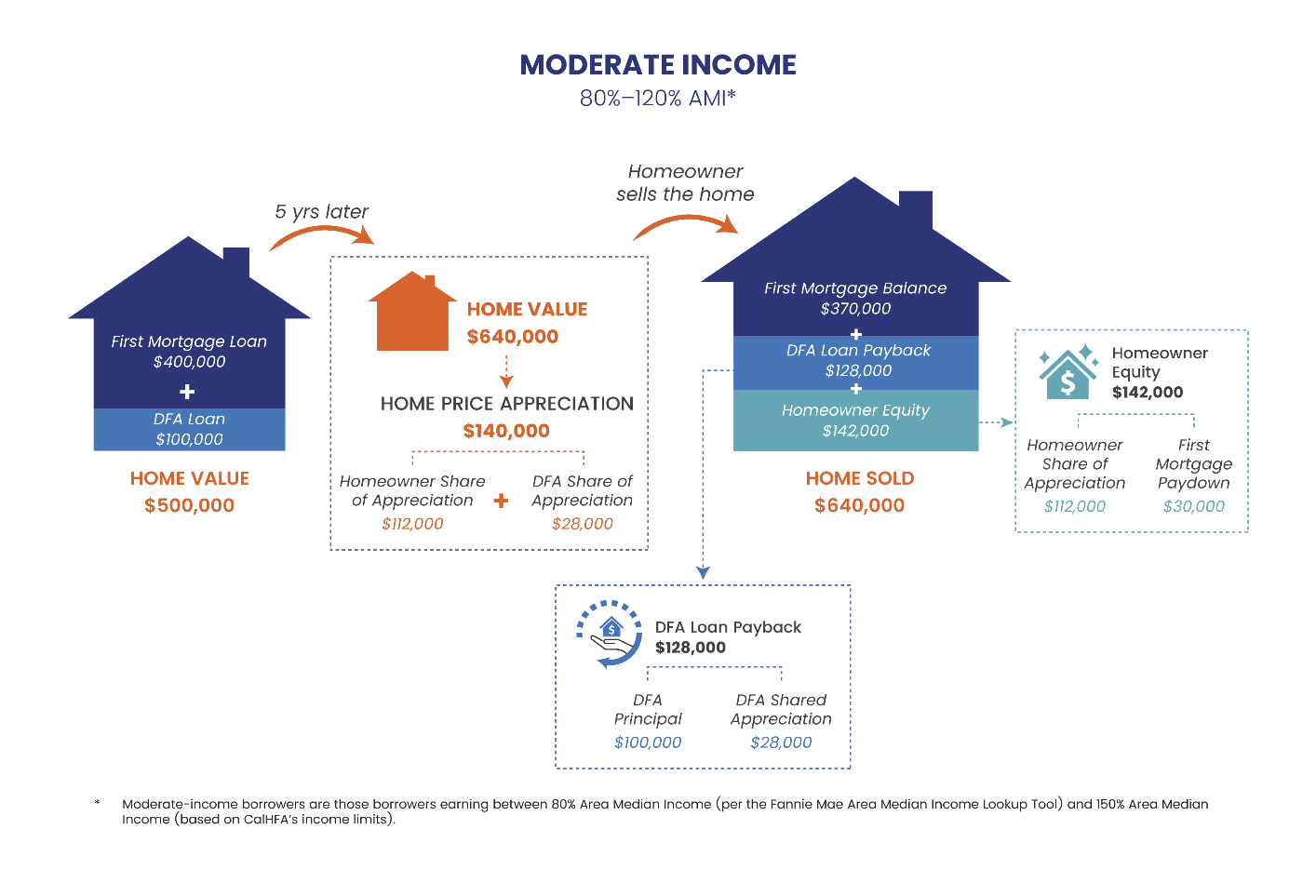

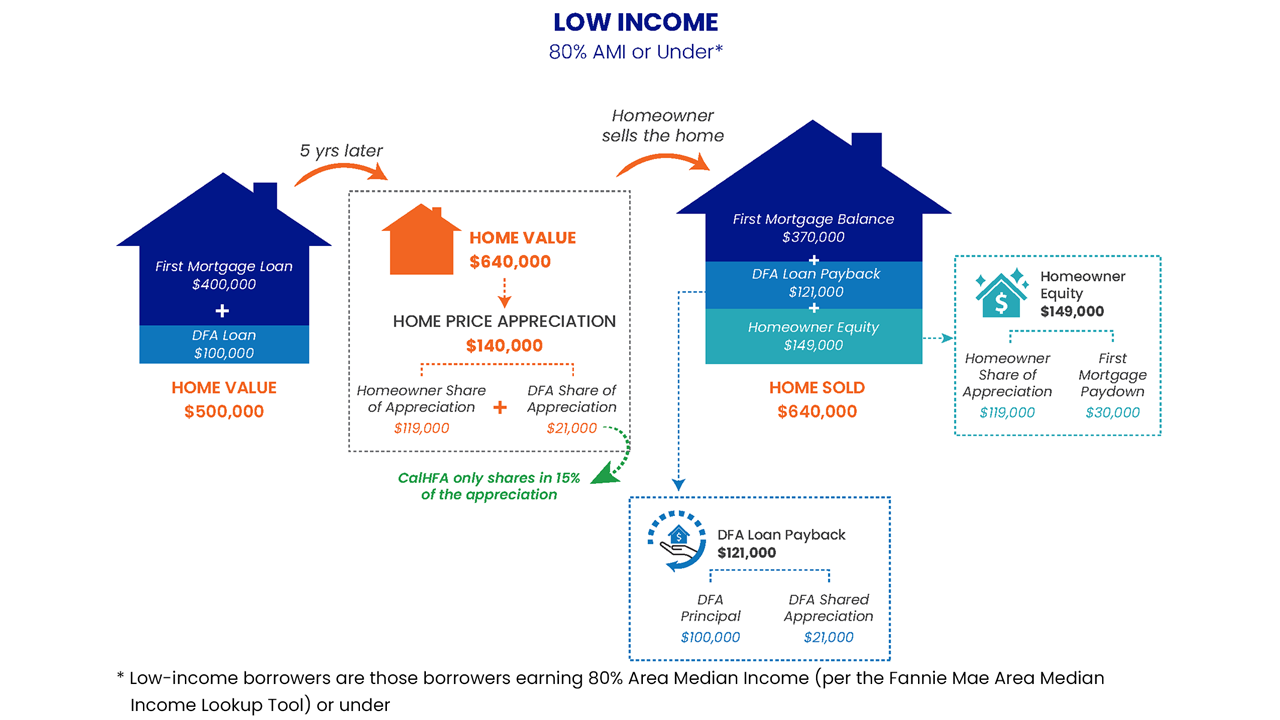

California Dream For All Shared Appreciation Loan

Video Spotlight | Eligibility | Next Steps | Program FAQ | Shared Appreciation

The Dream For All Shared Appreciation Loan is a down payment assistance program for first-time homebuyers to be used in conjunction with the Dream For All Conventional first mortgage for down payment and/or closing costs.

Upon sale or transfer of the home, the homebuyer repays the original down payment loan, plus a share of the appreciation in the value of the home.

Program Highlights

- Offers up to 20% for down payment or closing costs, not to exceed $150,000

- Homebuyer must register for a voucher. A randomized drawing will select registrants who will receive the voucher. This will not be first come, first served.

Eligibility

- One borrower must be a first-generation homebuyer.

- All borrowers must be first-time homebuyers.

- Income must meet CalHFA Income Limits for the county you are purchasing in.

Next Steps

- Applications have been audited and voucher statuses have been updated. Applicants should log into their account on the DFA portal to check their status.

- Not Selected: You can still work with a CalHFA Approved Lender and explore other CalHFA down payment assistance options like MyHome and CalPLUS with ZIP.

- Waitlist: check your voucher portal account periodically and monitor your email. If a voucher position becomes available and you are next on the waitlist, your status will change to Voucher Issued, and you will be notified right away by email.

- Voucher Issued: You will see this status if you are randomly selected to receive a voucher! We will email detailed instructions and next steps to you along with your voucher.

- Take the 1-hour California Dream For All education course which covers what shared appreciation is and how it affects your mortgage repayment. This course is delivered online and is free. Visit calhfadreamforall.com to get signed up and learn about shared appreciation now.

Program FAQ

California Dream For All Shared Appreciation Loan

Shared Appreciation

Shared Appreciation is a little more complex than a typical mortgage loan, so weíve put together a few examples for you.