Rates & Reservations for Lenders and Real Estate Agents

Loan Reservation Process | Duplicate Loans | Rate Lock Process | Rate Extension Process | Buydowns | Loan Reservation FAQs | Rate Lock FAQs | Rate Extension FAQs | Buydowns FAQs

Loan Reservation Process

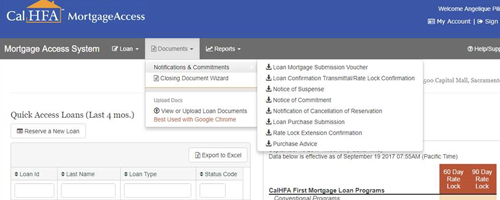

All CalHFA approved lenders have access to reserve loans through the CalHFA Mortgage Access System (MAS). Each lender has assigned an MAS Administrator within their own company to manage their employees' access to MAS. Lenders may have different processes for assigning CalHFA log-ins, passwords, and the reserving of CalHFA loans.

Reservations with a floating rate will be accepted from 6:00 a.m. to 11:59 p.m. Pacific Time, seven days a week. Lenders must reserve loans, including all CalHFA subordinate loans, using MAS prior to loan submission. The loan must be locked in MAS prior to loan submission for compliance review

Reservations may be made after a sales contract has been executed between the buyer and seller. Approved CalHFA Lenders may reserve funds on behalf of their correspondent lenders or mortgage brokers. The loan must be locked in MAS prior to loan submission for compliance review.

For more detailed information, please review the FAQs below, or you may contact CalHFA's Secondary Marketing Unit at:

916.326.8824 or email: RateLocks@CalHFA.ca.gov

Duplicate Loans

Borrowers may only have one active CalHFA reservation at any time and the loan may be placed in a possible duplicate reservation status 110 if the borrower currently has/had a CalHFA loan reservation. Loans placed in a 110 status may still be rate locked; however, no loan documents can be uploaded. Please contact CalHFA’s Secondary Marketing Unit at ratelocks@calhfa.ca.gov with the CalHFA Loan ID and borrower name. All status 110 reservations will be cleared within 24 hours.

Rate Lock Process

First mortgage rate locks will only be accepted between the hours of 8:00 a.m. and 3:00 p.m. PT Monday through Friday, excluding state-recognized holidays, and days that the U.S. financial markets are closed for business.

At the time of reservation the lender will have the option to lock or float the interest rate. Only lenders with full MAS access may lock the interest rate. If loan is reserved with the float option, the reservation period is 90 days on existing/resale properties, or 120 days on new construction properties; funds are not guaranteed until such time as loan is rate locked.

- At the time of rate lock, the lender will lock the loan(s) for 60 days for both existing/resale properties and new construction properties.

- For float option only:

- Lenders may lock the rate at any time during the reservation period if they choose the float option.

- To lock the rate when the float option is chosen, lenders must complete the Rate Lock in MAS. To help you with the rate lock process please see Guide: Locking a Rate

- Rate Locks will only be available for loans at status 110 (Reservation Pending-Possible Duplicate) and 120 (New Reservation). Rate lock expiration date will supersede the reservation expiration date.

- All loans must be funded, delivered and purchased by CalHFA’s master servicer, prior to rate lock expiration.

- Files should be received by the master servicer by the 45th day or earlier, to ensure time to clear conditions and purchase prior to rate lock expiration

- If the rate lock is cancelled for any reason – lender may not re-reserve/rate lock a new loan for the same borrower and property until 30 days from the current cancelled loan's expiration date.

- Each reservation is borrower, property, and lender specific.

- A new reservation for the same borrower with a new property is not subject to the 30-day Cancellation Policy wait period.

- CalHFA does not offer a "float down" option on rate locked loans

CalHFA subordinate loans reserved with a CalHFA first mortgage

- All subordinate loan(s) will receive the same reservation, lock and purchase periods as the CalHFA first mortgage. All subordinate loans must be delivered and purchased by CalHFA prior to the rate lock expiration.

- Subordinate loans should be submitted to CalHFA at the same time the first mortgage is submitted to the master servicer to ensure time to clear conditions and purchase prior to rate lock expiration.

Rate Extension Process

Lenders must request a rate lock extension via email from CalHFA’s Secondary Marketing Unit prior to the rate lock expiration date.

- All loans must be funded, delivered and purchased by both CalHFA’s master servicer and CalHFA, prior to the rate lock expiration.

- CalHFA offers extensions in 15 day increments (minimum allowed is 15 days)

- Up to a maximum of 60 days total from the original expiration date for all Resale properties

- Up to a maximum of 120 days total from the original expiration date for New Construction properties only

- The fees for all first mortgage loans will be net funded at the time of purchase by our master servicer.

- This fee may be charged to the borrower(s) or seller(s). Lenders must follow TRID fee requirements, refer to your compliance department for how to disclose this fee

- Rate locks for subordinate loans reserved with a CalHFA first mortgage are automatically extended at no cost when the first mortgage is extended.

- All subordinate loan extensions are subject to the following:

- New Preliminary Title Report/Property Profile showing no additional recorded loans since loan closing

- The first mortgage payment history showing the loan as current with no past delinquencies

- If a rate locked loan is cancelled for any reason – lender may not re-reserve/rate lock a new loan for the same borrower and property until 30 days from the current cancelled loan's expiration date

- Under no circumstances will CalHFA extend a rate lock period longer than 60 days for Resale properties or 120 days from the original expiration date for new construction properties

- CalHFA loans will not be purchased for any reason after the extension period expires

All expired CalHFA first mortgage loans and their associated subordinate loans, which have been submitted to CalHFA, will receive an automatic 30-day extension at a cost (if applicable).

Please note that CalHFA will only charge extension fees on loans that have not been purchased by either CalHFA and/or the master servicer.

All extensions will be in 15-day increments

Total due at end of each extension period (Cumulative):

| Extension Period | First Mortgage Extension Cost | Cumulative Extension Cost |

|---|---|---|

| For All Property Types | ||

| 15 days | 0.125% | 0.125% |

| 30 days | 0.125% | 0.250% |

| 45 days | 0.125% | 0.375% |

| 60 days | 0.125% | 0.500% |

| For New Construction Properties Only | ||

| 75 days | 0.250% | 0.750% |

| 90 days | 0.500% | 1.250% |

| 105 days | 0.750% | 2.000% |

| 120 days | 1.000% | 3.000% |

Extension Fees are subject to change without notice.

Buydowns – Permanent & Temporary

Permanent Buydowns

Permanent buydowns are done on a case-by-case basis and are permitted as per Fannie Mae, FHA, USDA or VA and master servicer guidelines.

All requests for permanent buydown must be emailed to Ratelocks@calhfa.ca.gov

- Buy downs are only allowed on our first mortgage loan programs

- On a CalHFA rate locked loan, you must provide the CalHFA first mortgage loan ID

- If the loan has NOT been locked with CalHFA:

- Provide the CalHFA first mortgage program they will be using

- When Conventional - standard or LI pricing

- Quote provided is good until 3 p.m. same day unless there is a mid-day rate change

Temporary Buydowns

2-1, 1-1 and 1-0 temporary buydowns are permitted as per Fannie Mae, FHA, USDA, VA and master servicer guidelines:

- Temporary buydowns are not processed through CalHFA’s Secondary Marketing Department

- Temporary buydowns are not allowed on any CalHFA Refinance product

- Loan must be credit qualified at Note rate

- Borrower paid Temporary Buydowns are not allowed

- Temporary buydown must be disclosed on the Final CD

- Buydown Agreement must be forwarded to Lakeview prior to loan purchase

- Buydown Funds will be net funded by Lakeview at time of first mortgage purchase

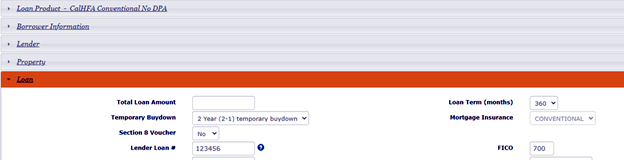

- Lender must enter the buydown in MAS

Sample Temporary Buydown Agreement:

A temporary buydown allows borrowers to reduce their effective monthly payment for a limited period of time through a temporary buydown of the interest rate.

The effective interest rate that a borrower pays during the buydown period of the mortgage is reduced as a result of the deposit of a lump sum of money into a buydown account. A portion of these funds are released each month to reduce the payment.

The actual note rate and monthly payment that the borrower is obligated to pay are never actually reduced, and the full rate and payment must be reflected on the mortgage documents.

The example below is based on Payments by Borrower and Payment from Buydown Account on a $200,000 30-year 7.000% Mortgage with a 2-1 Temporary Buydown

| Year | Interest Rate | Payment Received by Lender | Payment by borrower | Payment from Buydown Account |

|---|---|---|---|---|

| 1 | 5.000% | $1330.60 | $1073.64 | $259.96 |

| 2 | 6.000% | $1330.60 | $1199.10 | $131.50 |

| 3 - 30 | 7.000% | $1330.60 | $1330.60 | $0.00 |

Loan Reservation FAQs

Who should I contact to reserve my CalHFA loan?

When can I reserve my loan in MAS?

Can I reserve my loan before my borrower goes into contract?

If my reservation is not rate locked, can I cancel my floating reservation and re-reserve?

Rate Lock FAQs

How do I lock my interest rate?

Why is my "Lock Rate" button greyed out?

I accidentally locked my loan in MAS, can I have the rate removed

The rates have decreased since I locked in my loan, does CalHFA offer a “float down” option?

During what hours may I lock my loan?

The rate locked loan was cancelled by mistake. Can I reinstate my cancelled loan?

Is there a fee to cancel a reservation with either a rate lock or floating interest rate?

How do I print a duplicate Rate Lock Confirmation?

I locked my loan under the wrong program – how do I change the program in MAS?

Are temporary buydowns permitted?

Rate Extension FAQs

Can I get a rate lock extension?

How do I request an extension?

How many days can I extend my loan?

Can my borrower pay for the cost of the rate lock extension?

Does the closed loan need to be delivered to the master servicer by the rate expiration date?

Buydowns FAQs

Loan Scenario Calculator

Loan Scenario Calculator

The Scenario Calculator helps you compare CalHFA loans to determine what loan scenario works best for your client.

News & Updates

Dates for October Lender Training have been posted

Latest Bulletins

Program Bulletin #2025-09 - Updated CalHFA Borrower Affidavit and Certification

Program Bulletin #2025-08 - New CalHFA Refinance Programs

Program Bulletin #2025-07 - Update to Rate Lock Policy

Latest eNews Announcements

Enews 09/25/2025 - California Housing Finance Agency celebrates its 50th anniversary

Enews 09/19/2025 - CalHFA welcomes Tony Sertich as its new Executive Director

Enews 08/18/2025 - CalHFA helps thousands of Californians find a home

eNews announcements can be found on our Archived Page